Introduction

In today’s fast-paced business world, ensuring efficient and effective financial management is paramount, particularly for small businesses. This is where QuickBooks Online comes into play. Accounting software developed by Intuit, QuickBooks Online is a powerful tool that has revolutionized how small businesses manage their finances. It offers an array of features, from invoicing and bill management to payroll and financial report generation, all designed to simplify the process of running a business.

One of the key advantages of QuickBooks Online is its accessibility. Being a cloud-based service, it allows business owners and their employees to access their company’s financial data from anywhere, anytime. This flexibility and convenience make QuickBooks Online a vital asset to any small business aiming for growth and success.

If you’d like to watch a video version of the information below – you can check out this video of ours:

Setting Up QuickBooks Online

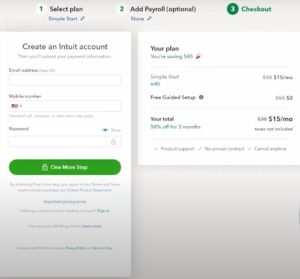

To start using QuickBooks Online, the first step is to create an account.

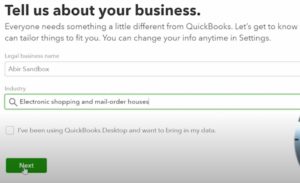

Visit the QuickBooks website, select your region, choose the appropriate subscription plan that suits your business needs, and follow the on-screen instructions to set up your account. Remember, the information you provide during the setup process will become the backbone of your financial data, so accuracy is essential. You can even use this link to get an additional discount above what they show online.

Once your account is set up, the next step is to configure your company settings and profile. In the “Account and Settings” section, you can input your business’s contact information, logo, invoice customization preferences, and payment and billing options. This is also where you can set up and manage users, adjusting their access level to your financial data based on their roles in your organization. Taking the time to carefully configure these settings will help ensure your QuickBooks Online account aligns with your business operations.

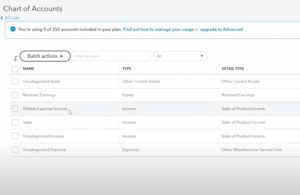

Chart of Accounts

One of the most critical components in QuickBooks Online is the chart of accounts. Essentially, this is where all of your business’s financial transactions get recorded, categorized into different accounts. Each account represents a type of asset, liability, equity, income, or expense. Understanding these account types is crucial in maintaining an accurate and informative chart of accounts.

Asset Accounts

These are the resources owned by your business that have future economic value, such as cash, accounts receivable, inventory, and fixed assets like equipment or buildings.

Liability Accounts

These represent the debts or obligations your business owes to others, including accounts payable, loans, mortgages, or customer prepayments.

Equity Accounts

These depict the residual interest in your company’s assets after deducting liabilities. It shows the owner’s investment in the business plus retained earnings or losses.

Income Accounts

These illustrate your company’s income-generating activities like sales revenue, interest income, or other revenue sources.

Expense Accounts

These denote the costs incurred in the process of earning revenues, such as rent, salaries, utilities, and advertising expenses.

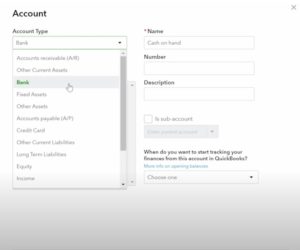

To create a new account, navigate to the “Chart of Accounts” section and click the “New” button. Here, you will specify the account type, detail type, name, description, and other pertinent details. Each detail type corresponds to a common business transaction to help you accurately categorize your accounts.

A well-organized chart of accounts is essential for tracking your business’s financial health, making it easier to monitor income, expenses, assets, liabilities, and equity. Moreover, a comprehensive and accurate chart of accounts simplifies tax preparation as it provides a clear view of deductible expenses and taxable income.

A good rule of thumb is to start with the most common accounts relevant to your business operations and add more as your business grows and evolves. If you’re not sure how to start building your chart of accounts, QuickBooks Online offers a predefined chart of accounts based on your industry, which you can import and modify as needed.

However, don’t worry about perfecting your chart of accounts right off the bat. It’s a dynamic tool that you can continuously adjust to suit your business’s changing needs. Regularly revisiting and updating your chart of accounts is a good practice as it keeps your financial records updated, ensuring you make informed business decisions based on current and accurate data.

Lastly, remember that setting up your chart of accounts can be complex and requires a solid understanding of your business’s financial needs. Therefore, consulting with an accountant or a QuickBooks expert can be extremely beneficial in setting up your chart of accounts properly. They can guide you in understanding how to classify different business transactions and maintain a well-organized chart of accounts, setting your business up for financial success.

Connecting Bank and Credit Card Accounts

Maintaining your financial records becomes a seamless process when you connect your bank and credit card accounts to QuickBooks Online. This feature ensures you’re always working with the most recent transactions and accurate data.

Once you’ve connected your accounts, QuickBooks automatically downloads your recent transactions, usually within the last 90 days. It then matches these downloaded transactions with the ones you’ve already entered into QuickBooks, preventing duplication.

However, what if you have transactions older than 90 days that you need to import? QuickBooks Online allows you to upload older transactions manually using a CSV, QFX, QBO, or OFX file from your bank. This flexibility ensures that your historical financial data is always complete.

In terms of security, rest assured that QuickBooks Online uses advanced security measures to keep your financial data safe. When you enter your banking login details, QuickBooks uses this information only to access your transaction data, not to access your bank account directly.

Furthermore, you can connect multiple bank or credit card accounts. This feature is particularly beneficial for businesses with complex banking structures or those using multiple credit cards for different types of expenses. QuickBooks Online will handle transactions from all these sources separately, providing clarity and minimizing confusion in your financial records.

Monthly Reconciliations

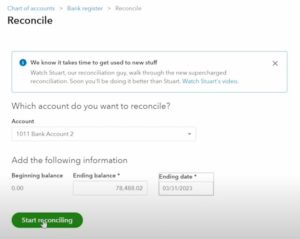

Monthly reconciliations are an essential component of managing your business’s finances. By reconciling your accounts, you are comparing your QuickBooks records with your bank or credit card statements to ensure they match.

To reconcile an account, go to the “Accounting” menu and select “Reconcile”. You’ll need to choose the account you want to reconcile and enter the ending balance and ending date from your bank statement. QuickBooks Online then displays a list of transactions. For each transaction that appears on your statement, you’ll check it off in QuickBooks Online.

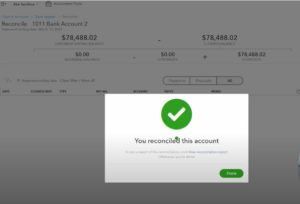

If everything matches, you’ll see a difference of zero, indicating that your accounts are reconciled. If there’s a discrepancy, QuickBooks Online provides tools to help you find and fix the issue. Discrepancies can occur due to omitted transactions, duplicate transactions, or discrepancies in recorded transaction amounts.

Reconciling your accounts monthly provides several benefits. It helps detect any fraudulent transactions or unauthorized activity in your bank account, as you are verifying every transaction recorded in QuickBooks against your bank statement. Regular reconciliation also helps identify errors or omissions, ensuring your financial records are accurate.

Moreover, monthly reconciliation ensures your financial reports, such as your profit and loss statement and balance sheet, are accurate. These reports are crucial for making informed business decisions and for preparing your tax returns.

Lastly, if you have a habit of reconciling your accounts monthly, it makes the year-end financial review process smoother and less time-consuming. It also makes it easier to work with an accountant, as they will have accurate, up-to-date financial records to work from.

In conclusion, while connecting your bank and credit card accounts to QuickBooks Online can significantly streamline your financial management, regular monthly reconciliations are crucial to maintaining the accuracy of your financial records.

Invoicing

The ability to generate and send professional invoices is at the heart of QuickBooks Online. It is a tool designed to support businesses in maintaining positive cash flow and strong client relationships.

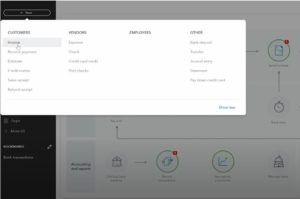

Creating an invoice is quite straightforward. Under the “+ New” button, select “Invoice” and choose the customer you’re billing. Fill in the product or service you’re charging for, along with its price. If applicable, you can also add sales tax.

Customizing your invoices adds a touch of professionalism and branding to your communication. You can add your company logo, choose a template, and even select a color scheme under the “Custom Form Styles” menu. You can also set up recurring invoices for long-term clients to automate the billing process.

Terms of payment are crucial, and QuickBooks Online allows you to specify these for each customer. You can set up standard terms like Net 30 (payment due in 30 days) or create custom terms. Establishing clear payment terms can prevent confusion and disputes, ensuring you receive your payments promptly.

Moreover, QuickBooks Online can send automatic payment reminders to your customers. This feature saves you the time and effort involved in tracking due payments.

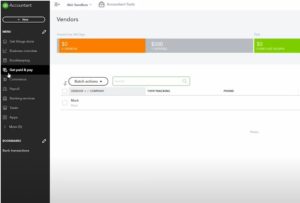

Managing Bills

QuickBooks Online also simplifies the process of managing bills. Instead of losing track of numerous bills, you can enter each one into QuickBooks when it arrives, with its due date. This feature helps you avoid late payment penalties and maintain a good credit rating.

To enter a bill, go to the “+ New” button and select “Bill”. Choose the vendor, fill in the due date, and add the products or services you received. QuickBooks Online keeps track of all entered bills and displays them in the “Bills and Accounts Payable” section, where you can review and pay them.

When you’re ready to pay a bill, QuickBooks matches it with a payment, linking the bill and the payment together in your accounts. This process ensures your expense tracking is accurate and comprehensive.

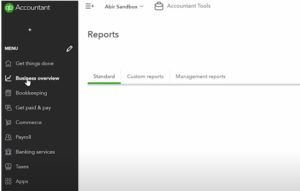

Reports

The reporting feature in QuickBooks Online is another key tool for business owners and managers. The software provides an array of reports, allowing you to understand your business’s financial situation from different angles

There are three reports that are particularly useful: the balance sheet, accounts receivable aging summary, and profit and loss report.

The balance sheet provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time. It is crucial for assessing your business’s overall financial health.

The accounts receivable aging summary breaks down the money due to you by how long the invoice has been outstanding. This report can help identify slow-paying customers and manage your cash flow effectively.

The profit and loss report, also known as an income statement, summarizes your revenues, costs, and expenses over a period. It provides an overview of your company’s profitability, helping you make informed financial decisions.

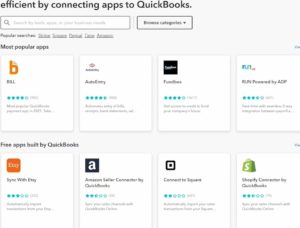

Additional Features and Apps

QuickBooks Online also offers various additional features and apps that can be integrated to enhance its functionality.

One noteworthy app is TSheets, which is excellent for time tracking. If your business bills clients by the hour, this app can improve accuracy and simplify billing.

Another useful integration is with PayPal. If you use PayPal to accept payments, integrating it with QuickBooks Online ensures your financial data is always updated.

There’s also an app for managing sales tax, which can be a time-consuming task. The app calculates the sales tax due on each sale, based on the customer’s location and the nature of the goods or services you’re selling.

Conclusion

QuickBooks Online is a powerful tool that can simplify financial management for businesses of all sizes. Its versatility allows it to handle various aspects of financial management

.jpg)

.jpg)